Which of the Following Accurately Describes a Participating Insurance Policy

Notify the insurance company in writing. A flexible premium deposit fund and a monthly renewable term insurance policy.

Eur Lex C 2021 9128 En Eur Lex

Stock companies sell only non-participating policies B Mutual participating companies sell only non-participating policies.

. Claim must be paid after proof of loss is received. Lucy is applying for an individual health insurance policy. All of the following statements about life insurance and the risk it covers are true.

The Branch Office System General Agency System American Agency System Direct Writers and Direct MailResponse are the marketing and distribution systems used by insurers. A participating life insurance policy is one that pays an annual dividend a lump sum of money tied to the performance of the life insurance company. Answer C is correct.

A mutual fund and an endowment policy b. When a company is licensed by the Department of Insurance to do business in this state it becomes. Larry has a Major Medical Expense policy for his family with a 1000 per familyper year deductible and an 8020.

Dividends are generated from the profits of the insurance company that sold the policy and are typically paid out on an annual basis over the life of the policy. Policyowners are not entitled to vote for members of the board of directors. Notify the insurance company in writing.

Claim will be denied. In an Accident Health policy the insuring clause states the amount of benefits to be paid. Be definable measurable uncertain and not catastrophic.

An example of endodontic treatment is a. Dividends are generated from the profits of the insurance company that sold the policy and are typically paid out. Which of the following combinations best describe a universal life insurance policy.

Participating life insurance policy A mutual insurer issues life insurance policies that provide a return of divisible surplus. A participating policy is an insurance contract that pays dividends to the policy holder. Policyowners may be entitled to receive dividends b.

Which statement most accurately describes a unilateral contract. Which of the following statements does not accurately describe the tax treatment of premiums and benefits of individual accident and health insurance. If the insured would like to cancel the policy heshe must.

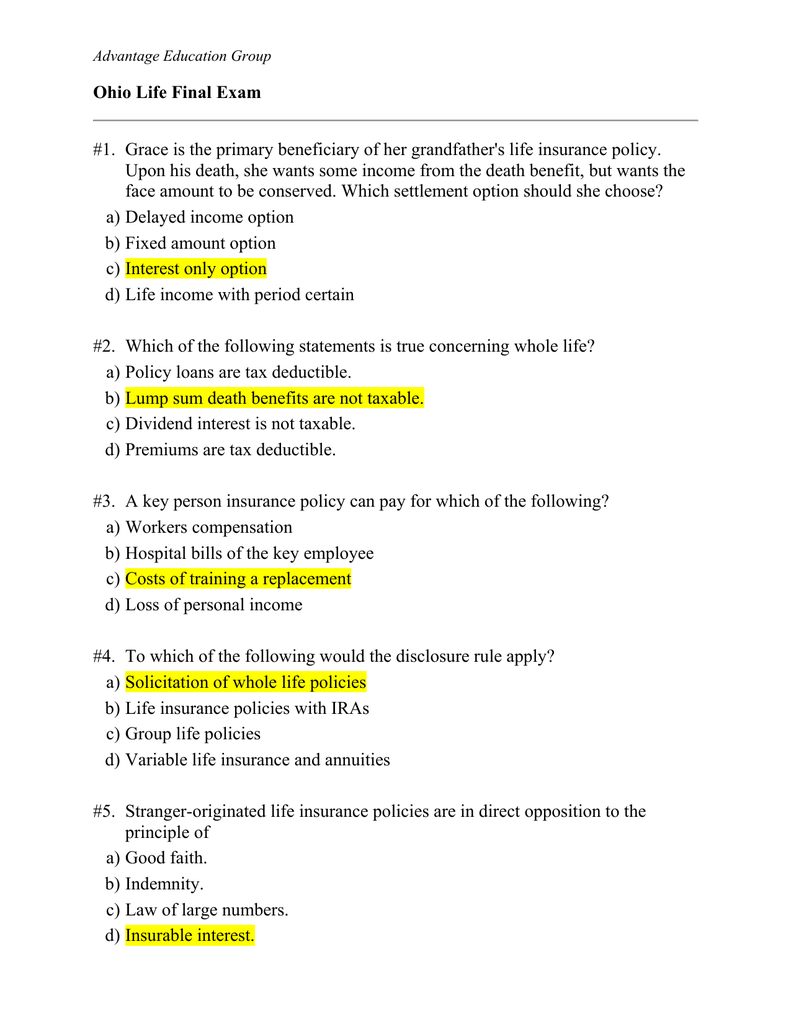

A Both parties to the contract are bound to the terms. The correct answer is 0. Nonparticipating life insurance policy participating life insurance policy divisible surplus life insurance policy straight life insurance policy.

The policy provision that entitles the insurer to establish conditions the insured must meet while a claim is pending is. A flexible premium deposit fund and a monthly renewable term insurance policy. The process of determining if an applicant is an insurable risk.

Provide a reason for canceling. Concealment is being silent regarding material facts to the underwriting process. Most noncontributory group health plans require 100 participation by eligible members.

-not taxable since the IRS treats them as a return of a portion of the premium paid -paid at a fixed rate every year -taxable as ordinary income -guaranteed. Stock companies allow their policyowners to share in any company earnings d. Which of the following accurately describes a participating insurance policy.

The extent to which an insurer is subject to a possible losses. In health insurance policies a waiver of premium provision keeps the coverage in force without premium payments. False statements made by an applicant for insurance are.

Claim must be paid after proof of loss is received. Wait until the end of the calendar year. The correct answer is C - misrepresentation.

A participating insurance policy is one in which the policyowner receives dividends deriving from the companys divisible surplus. A A mutual fund and an endowment policy b A term insurance policy and a whole life policy c A modified endowment policy and an annual term insurance policy d A flexible premium deposit fund and a monthly renewable term insurance policy. A participating policy is an insurance contract that pays dividends to the holder.

Policyowners pay assessments for company losses c. Time Limit on Certain Defenses. The authority of a producer or agent that is written in hisher contract is called.

Under Florida law there is no specific minimum percentage participation for employees covered by employee group health insurance. Nearly all participating life insurance policies are whole life a type of permanent insurance. Which of the following statements describes the purpose of the Insuring clause.

Which describe a participating life insurance policy. A term insurance policy and a whole life policy c. Lack of offer and acceptance.

Non-participating life insurance is a policy that doesnt pay a dividend. The correct answer is C. Notify an insurer of a claim within a specified time.

Insurer does not have to pay the claim. The Notice of Claims provision requires a policyowner to. Only a percentage of the claim will be paid.

A modified endowment policy and an annual term insurance policy d. What kind of life insurance policy issued by a mutual insurer provides a return of divisible surplus. Which of the following best describes how a policy that uses the accidental bodily injurydefinition of an accident differs from the one that uses the accidental means definition.

On a participating insurance policy issued by a mutual insurance company dividends paid to policyholders are. From an insurance perspective underwriting is best defined as. After an insured has become totally disabled as defined in the policy After an insured has become totally disabled as defined in the.

Notify the insurance company by telephone.

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Comments

Post a Comment